The Greatest Guide To Clark Wealth Partners

Table of ContentsClark Wealth Partners Things To Know Before You Get ThisIndicators on Clark Wealth Partners You Should KnowThings about Clark Wealth Partners9 Simple Techniques For Clark Wealth PartnersClark Wealth Partners for DummiesHow Clark Wealth Partners can Save You Time, Stress, and Money.Our Clark Wealth Partners StatementsThe Facts About Clark Wealth Partners Uncovered

Typical factors to think about a monetary expert are: If your monetary scenario has actually ended up being extra complex, or you lack confidence in your money-managing abilities. Conserving or browsing significant life events like marital relationship, separation, kids, inheritance, or task change that might dramatically impact your economic situation. Browsing the change from saving for retirement to preserving riches throughout retirement and just how to create a strong retired life earnings strategy.New modern technology has caused even more thorough automated financial tools, like robo-advisors. It's up to you to investigate and determine the right fit - https://www.cybo.com/US-biz/clark-wealth-partners. Inevitably, a good monetary advisor ought to be as mindful of your investments as they are with their very own, avoiding too much costs, saving money on taxes, and being as clear as feasible regarding your gains and losses

The Greatest Guide To Clark Wealth Partners

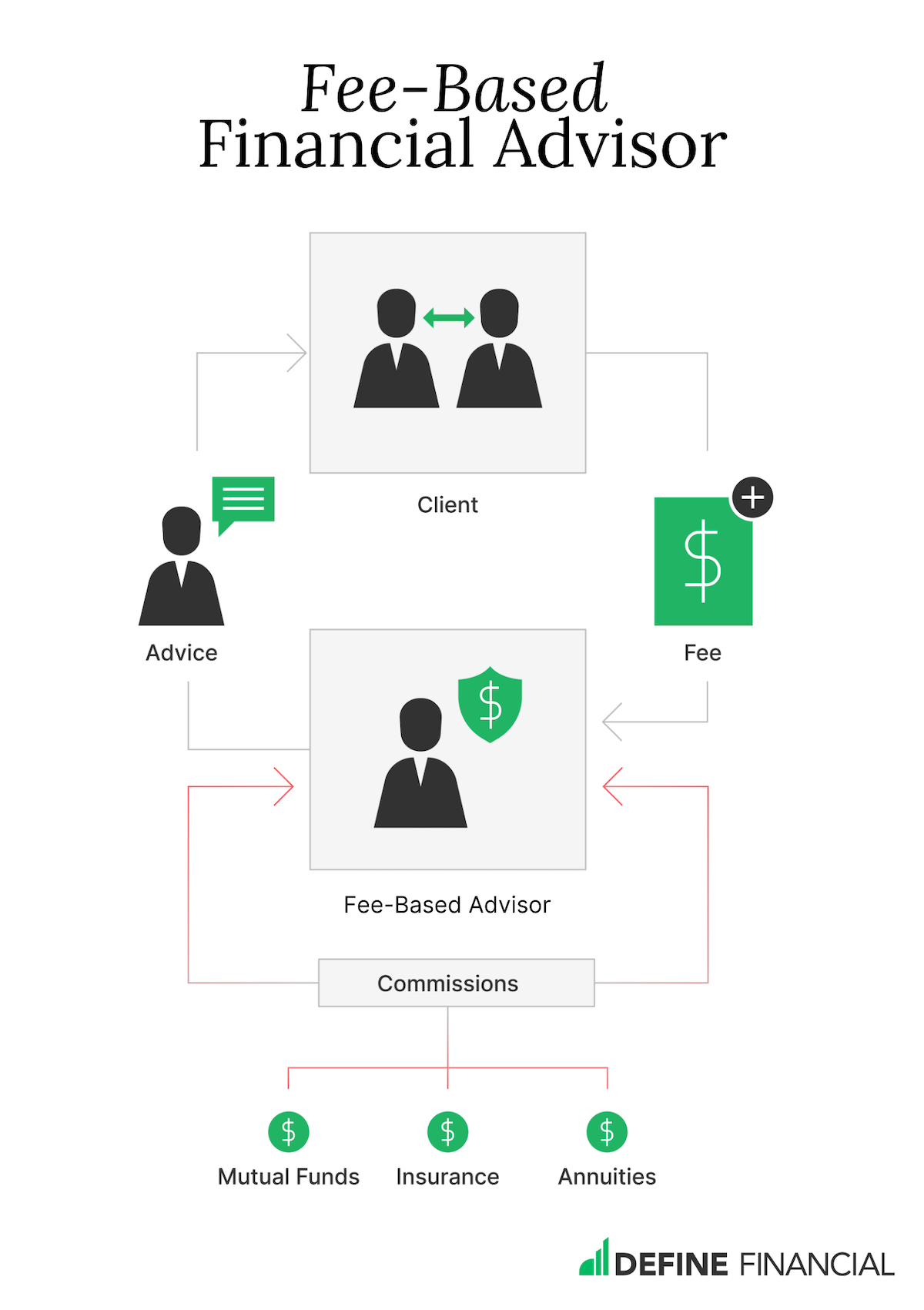

Gaining a payment on item recommendations does not always mean your fee-based consultant works versus your finest passions. They may be a lot more inclined to recommend products and solutions on which they gain a payment, which might or may not be in your ideal passion. A fiduciary is legitimately bound to place their customer's rate of interests first.

They might adhere to a freely kept track of "suitability" standard if they're not signed up fiduciaries. This basic enables them to make referrals for investments and services as long as they suit their customer's goals, threat resistance, and monetary situation. This can translate to suggestions that will also earn them money. On the various other hand, fiduciary advisors are lawfully obligated to act in their client's benefit rather than their own.

The Main Principles Of Clark Wealth Partners

ExperienceTessa reported on all points investing deep-diving into complex financial subjects, clarifying lesser-known financial investment avenues, and discovering means readers can work the system to their benefit. As a personal finance expert in her 20s, Tessa is acutely knowledgeable about the effects time and uncertainty have on your financial investment choices.

It was a targeted promotion, and it functioned. Read more Check out much less.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

There's no single path to turning into one, with some individuals beginning in financial or insurance, while others begin in bookkeeping. 1Most economic coordinators begin with a bachelor's level in money, business economics, audit, business, or a related subject. A four-year level offers a strong structure for jobs in investments, budgeting, and client services.

Not known Facts About Clark Wealth Partners

Typical examples include the FINRA Series 7 and Collection 65 tests for safeties, or a state-issued insurance coverage permit for offering life or wellness insurance. While credentials might not be lawfully required for all intending duties, companies and customers commonly see them as a benchmark of professionalism. We check out optional qualifications in the next area.

A lot of monetary planners have 1-3 years of experience and experience with financial products, compliance requirements, and direct client interaction. A strong instructional history is important, but experience shows the capacity to use concept in real-world setups. Some programs integrate both, allowing you to complete coursework while earning supervised hours through teaching fellowships and practicums.

The Best Strategy To Use For Clark Wealth Partners

Several go into the area after operating in financial, audit, or insurance coverage, and the shift needs perseverance, networking, and frequently innovative qualifications. Early years can bring lengthy hours, pressure to construct a client base, and the requirement to continuously verify your knowledge. Still, the occupation provides solid long-term possibility. Financial organizers appreciate the possibility to function carefully with customers, guide essential life decisions, and commonly attain versatility in schedules or self-employment.

Riches supervisors can boost their incomes via payments, property fees, and performance perks. Economic supervisors manage a group of economic coordinators and advisers, setting department strategy, handling compliance, budgeting, and guiding internal procedures. They spent less time on the client-facing side of the market. Virtually all economic supervisors hold a bachelor's degree, and several have an MBA or similar graduate level.

The Best Guide To Clark Wealth Partners

Optional qualifications, such as the CFP, typically need additional coursework and testing, which can expand the timeline by a number of years. According to the Bureau of Labor Statistics, individual financial consultants earn a mean annual yearly wage of $102,140, with leading income earners earning over $239,000.

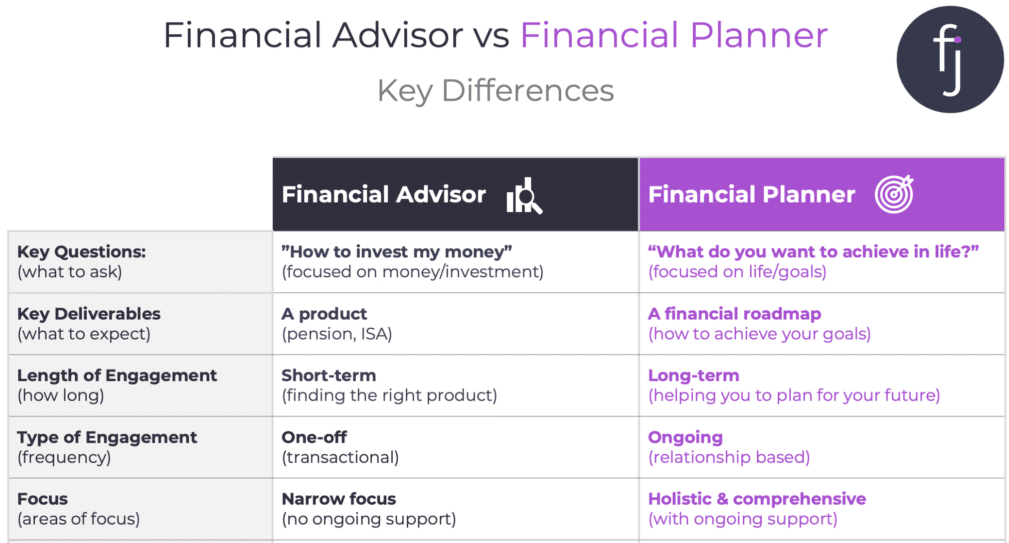

In various other districts, there are policies that require them to satisfy particular needs to use the monetary consultant or economic organizer titles. For financial planners, there are 3 common classifications: Qualified, Personal and Registered Financial Coordinator.

Unknown Facts About Clark Wealth Partners

Those on income may have a reward to promote the product or services their employers use. Where to find a financial advisor will certainly depend upon the sort of guidance you need. These organizations have personnel who might aid you understand and purchase particular kinds of investments. For example, term deposits, guaranteed financial investment certificates (GICs) and common funds.